Summary

The government will pay you quite a bit more per month if you’re willing to delay the start of social security. Is it worth it to you? Mostly it’s a bet between you and the government on how long you’ll live and you have private knowledge (you know your own health and whether you do BASE jumping), so you can probably beat the government. If you think you’ll live as long or longer than the average American your age, it’s a good idea to delay the start of social security (at least it is for me).

But there is another factor – social security is underfunded. A likely outcome is that benefits are reduced, and possibly reduced even more for people with higher income. If your future benefits will be reduced it might make sense to start earlier so you can get as many years at today’s benefits level as possible. That makes it a tough (political) call.

Here are the numbers – using me as an example.

The Benefits

Here is my own case (from my account at the Social Security website) as of Sept 24 2024.

| Age | Month / Year | Monthly Benefit |

| 64 | July 2025 | 3021 |

| 65 | July 2026 | 3278 |

| 66 | July 2027 | 3536 |

| 67 | July 2028 | 3795 |

| 68 | July 2029 | 3953 |

| 69 | July 2030 | 4263 |

| 70 | July 2031 | 4727 |

How Long I’ll Live

So the government says what it thinks the average years-to-live is in this table (courtesy of Fidelity).

Since I am 63, the government thinks I will live another 24.5 years (to age 87.5).

Figuring What each Scenario is Worth

When considering choices on when to spend or receive money, we should use the discount rate of a reference investment of comparable risk (it should be something we could actually do).

“If I had a choice between this target investment and a reference investment of similar risk, which one gives me the better return?”

There are two ways to work this – they are mathematically equivalent:

- Calculate the internal rate of return of the target and reference investment and see if the target is higher.

- Calculate the net present value (NPV) of the target using as a discount factor the internal rate of return of the reference investment; the target is a good choice if its NPV is greater than 0, neutral if it is 0, and bad if it is less than zero.

I am going to use the second approach. Since social security is inflation adjusted, I am looking for the real (subtracting inflation) rate of return of an equally risky investment.

Social security is backed by the US government. If I could count on the government not to change what it is doing (we will reconsider later), it has the same risk as treasuries. I used the longest term treasury securities I could easily get data on, 10 year Treasury Bonds. From a site at NYU, I get the average real (after inflation) annual return on 10 year T Bonds as 1.86% (averaged over the period 1928-2023).

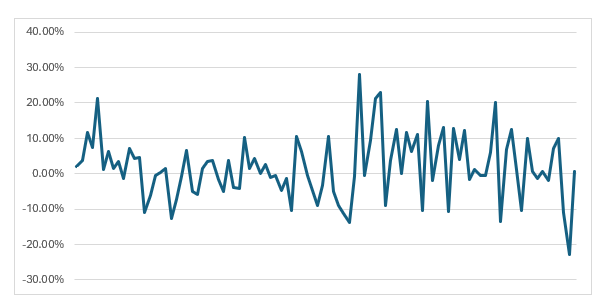

Here is the after inflation return by year from 1928-2023:

Now I want to vary my lifetime by -10, -5, 0, +5, +10 years relative to the IRS expectation and see what the NPV of my social security payouts will be under each starting scenario. When I defer the start, I get fewer years of payout, and they are also later in time, but the rate is higher. What happens to the NPV?

By adopting real (inflation discounted) payments and returns that are constant, we can use simple formulas for the relevant NPVs. Basically we just use two things:

The NPV under discount rate r of an amount x paid n years in the future is

[math]x \over (1+r)^n[/math]

(If you had this amount and it was accruing compound interest, that’s what it would be worth after n years. You are neutral between that amount today and the amount x in n years, happy to take either one.)

The NPV under discount rate r of an amount x paid each year from now into the indefinite future is x/r. (This follows from the formula for an infinite geometric series, a pretty result in mathematics.)

From this we can get the NPV of a constant series of payments starting m years in the future and ending n years in the future is:

[math]{x \over r} {1 \over {(1+r)^m}}-{x \over r}{1 \over {(1+r)^n}} [/math]

(We take an infinite sequence starting in year m, figure its NPV, then subtract from that the NPV of an infinite series starting in year m.)

This produces the following table (all quantities in thousands of dollars):

| Age to Start | Date of Death Relative to IRS Life Expectancy | ||||

| -10 | -5 | 0 | 5 | 10 | |

| 64 | 443 | 575 | 696 | 806 | 907 |

| 65 | 442 | 586 | 717 | 836 | 946 |

| 66 | 436 | 591 | 732 | 861 | 979 |

| 67 | 425 | 591 | 743 | 881 | 1008 |

| 68 | 398 | 572 | 730 | 874 | 1006 |

| 69 | 383 | 570 | 740 | 896 | 1038 |

| 70 | 374 | 581 | 770 | 943 | 1100 |

The cells in red are the maximum under each life expectancy scenario.

Note that the conclusion doesn’t change if I increase the discount rate to 2.7% which is the real return on 10 year T-bonds for the period 1974-2023 rather than 1928-2023; the only shift is that the maximum for the -5 column moves up to age 66.

Take Away

If I think I’ll live 10 years less than the average US citizen of my age, I should start taking social security as soon as I can. If I think I’ll live 5 years less, then I should start taking it at age 66 or 67. Otherwise, I should wait until I am 70 to start.

But is Social Security Really That Secure

But here’s a problem. Social security is running out of money, which means the government will have to do something – either raising taxes on current earners, shifting spending from other government uses (and entitlement programs already dominate spending), or reducing benefits. If benefits are reduced, they are likely to be reduced more for higher earners. There may be some grandfathering effect (meaning if you started earlier you don’t see as much reduction). We don’t know these things but it doesn’t look good.

We could ask the following – how much higher would I need to make the discount rate (that is, the rate of return on an “equivalently risky investment”) for me to want to start taking at age 67 (rather than earlier or later) if I will live as long as the average American of my age? The answer is 4.1%.

Here are the after inflation returns of other investments averaged over 1928-2023.

| 3-Month T Bills | 0.32% |

| Real Estate | 1.28% |

| 10 Year T Bonds | 1.86% |

| Gold | 3.27% |

| Baa Corp Bonds | 3.90% |

| S&P 500 (incl dividends) | 8.40% |

(for those of you who think real estate is a much better investment than that, you are right if we look more recently. Between 1974 and 2023, real estate returned 1.6% after inflation but between 2014 and 2023, it returned 4.16%).

Basically, if I think the US government’s commitment to social security is more uncertain (benefits for me at the current levels) than mid-level corporations paying their debt but perhaps not as wild a ride as the stock market, I would be tempted to move up my start date to 67 or earlier.

So, let’s run a specific scenario. Social security should run out of money around 2031, triggering an automatic 20% rate cut. Let’s assume Congress is slightly proactive and decides to make deeper cuts for folks with higher income. So let’s model a 30% benefit cut starting in 2031. We’ll assume I live as long as the average American my age. Then the NPV of my social security benefits looks like.

| Age to Start | Current Benefits (no cuts in the future) | Reduced Benefits (30% cut in 2031) |

| 64 | 696 | 548 |

| 65 | 717 | 557 |

| 66 | 732 | 560 |

| 67 | 743 | 558 |

| 68 | 730 | 537 |

| 69 | 740 | 532 |

| 70 | 777 | 540 |

So, this size of cut at this time makes enough of a difference in NPV that I’d want to move my start date up to age 66.

Complications

Taxes

Social security benefits are partially taxed by the federal government depending on what your gross income is. As your income increases, the tax rate on benefits approaches 85%. Social security benefits are not taxed by the State of California. But, given they are mostly taxed federally and tax-free at the state level – and the reference investment of T-bonds is taxed federally and tax-free at the state level – I ignore tax implications.

Spousal Benefit

The spousal benefit is 50% of spouse’s retirement benefit at spouse’s full retirement age. You can get this instead of your own benefit if you don’t have one or it is small. You have to be at least 62 to apply but if you apply before your own full retirement age, your benefits will be permanently reduced.

| Year of Birth | Full Retirement Age |

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and later | 67 |

The spouse’s retirement benefit at full retirement age can be found from their account on the Social Security web site. Note that your spouse must have accumulated 40 social security credits, which roughly means working 10 years with wages above $6,920 in each of those years.

When you apply for social security benefits, the Social Security agency automatically determines what your spousal benefit would be if your spouse is already taking benefits and either pays you that or your own benefit, whichever is greater.

If your spouse hasn’t yet started taking benefits, you can start taking your own (if you have some), then when they do start taking benefits, you can apply and switch to taking half their full retirement benefit or stick with your own.

My Own Decision

I think I am likely to live longer than the average American based on my own health, so I would naturally push out to age 70 to start benefits and take advantage of the government’s largesse, especially the last year kicker. But I think my benefits will be cut significantly at some point in the future to address insolvency. So, I plan to start taking benefits at my full retirement age of 67.

Leave a Reply